deduction 50 ministry of finance

वतत मतरलय Ministry of Finance. Now additional deduction of 15 lakh is available for.

Usd Vs Inr Rising Astrology Predictions Astrology Predictions Astrology Predictions

According to the ministry the state will impose pay deductions on salary brackets above MVR 20000 for all civil servants.

. 880 of 4132021 on tax deduction and the ministers recommendation to return to. Notification of Diyat for the Financial Year 2016-17. The union said in a statement that it was surprised this month by the Minister of Finance circular to the employees and local authorities to implement a 50 per cent deduction of the meal allowance.

Or b A training programme conducted by a training institution. 150 lakh under section 80 C of the Income Tax Act. Submission of the completed and signed form will provide to the Government authorization for the salary deductions.

Al-Tamimi stated in a statement received by the Iraqi News Agency INA that it rejects what was stated in the Finance Ministrys artical No. On Tuesday January 24th 2012. Employees own Contribution towards NPS Tier-I is eligible for tax deduction under section 80 CCD 1 of the Income Tax Act within the overall ceiling of Rs.

On 19 February 2020 the German Ministry of Finance MoF issued guidance concerning harmful preferential regimes in connection with the German royalty deduction limitation rule. Department of Expenditure comes under Ministry Of Finance. The German royalty deduction limitation rule Sec.

000 000 003 000 12500 5200 650000 250 5200. If you claim tax deductions for tertiary education expenses first-time home ownership alimony or maintenance payments venture capital tax credits and or private annuities annuities other than those offered by your employer you must seek approval from the Inland Revenue Division by submitting the TD1 form to the Taxpayer Section at the. 11 Feb 2022Owned by Department of Expenditure Ministry of Finance Government of India Designed.

The Danish Ministry of Finance has announced a package of policy proposals to support labor businesses and a greener Denmark. If the taxpayer has been established before September 30th 2019 the super-deduction policy can be applied if the above condition is met during the period October 2018 September 2019 or during the actual business period if the. Ministry of Finance on May 16 released a circular indicating the decision to implement pay deductions and salary ceilings on government staff and political appointees effective from May onwards.

PUA 611992 YA 1992 iii Company carrying on a hotel or tour operating business a A training programme approved by the. On 14 July 2008 the Ministry of Finance BMF published official guidance in the form of a letter dated 4 July 2008 on the application of the new rules on limitation of interest deduction contained in Sec. The status of the United States US-Foreign Derived Intangible Income FDII deduction remains unchanged and is still under review for background see EY Global Tax Alert German Ministry of Finance publishes guidance on royalty deduction limitation rule dated 26 February 2020.

Additionally since no tax rate reprieve is in the offing the finance ministry may enhance the standard deduction of 50000 in the upcoming budget. On 27 January 2022 the German Ministry of Finance MoF published new guidance relating to the German royalty deduction limitation rule dated 5 January 2022 and 6 January 2022. The Finance Minister stressed that Public investment must continue to take the lead and pump-prime the private investment and demand in 2022-23 and therefore the outlay for capital expenditure in the Union Budget is once again being stepped up sharply by 354 per cent from Rs 554 lakh crore in the current year to Rs 750 lakh crore in 2022-23.

Therefore the Ministry of Finance would like to inform the companies that have to deduct the tax of Article 51 of Law 4972003 and its amendments of the obligation to calculate the due tax on interests dividends and revenues. Website Content Managed by Owned by Department of Expenditure Ministry of Finance Government of India Designed Developed and Hosted by National Informatics Centre NIC Last Updated. 4j Income Tax Act partially or wholly disallows the deduction of royalty payments preferentially.

8a of the Corporate Income Tax Act Körperschaftsteuergesetz KStGThe BMFs letter contains detailed. MINISTRY OF FINANCE AND SOCIAL SECURITY FOR OFFICIAL USE ONLY. Name of Employee Salary 1st Week 2nd Week 3rd Week 4th Week 5th Week Total Deduction No.

4h of the Income Tax Act Einkommensteuergesetz EStG and Sec. The major part of the spending would be on highways to affordable housing in a bid. Refer to section B52 for details of eligible outgoings and expenses.

We would like to show you a description here but the site wont allow us. The decree capped cummulative deductions at 50 percent of the FOB value. Standard deduction of 40000 was introduced by the then finance minister Arun Jaitley in 2018 and was enhanced to 50000 by Piyush Goyal in 2019 when he presented the budget while holding.

Finance Minister Nirmala Sitharaman presented a Rs 3945 lakh crore Union Budget 2022 in the Parliament today. Minister of Finance or any agency appointed by the Minister of Finance. Grant of Increase in Pension to Pensioners of the Federal Government.

The decree identifies and lists harmful preferential tax regimes in a non-exhaustive list which should fall under the German royalty deduction limitation rule. The Attorney-General of the Federation AGF and Minister of Justice Abubakar Malami stated this via a counter-affidavit to a suit by Rivers State challenging the commencement of monthly deduction. Skip to main content.

For businesses one of the main tax proposals is to make the 130 deduction for RD expenses a permanent measure with a tax value deduction limit of DKK 50 million. Of weeks worked W Comments MonthlyWeekly M Gross Income B TOTAL It is hereby certified that the information noted above is correct. The union described the ministers decision as unacceptable and prejudiced against the workers earnings.

In order to be eligible for this treatment the taxpayer shall derive at least 50 of its total sales from the provision of life services. Revision of Basic Pay Scales Allowances of Civil Servants of the Federal Government 2016 01-07-2016. The Finance Ministry on Monday announced that it has extended tax holiday for affordable housing for projects approved till 31 March 2022.

Financial Secretary Ministry of Finance Sir Cecil Wallace-Whitfield Centre West Bay Street PO. 19 46 to 50 52 to 55 and 70 will not be printed and only typed or manuscript copies may be used when necessary. From FY 2015-16 the subscriber is also.

Memorandum of instructions for deduction of Income Tax from salaries etc. Grant of MPhil Allowance Rs. MINISTRY OF FINANCE Treasury Rules of the Federal Government.

Completed forms must be received at the address below no later than 500 pm. Minister of Finance Mohamed Maait expounded that the decree comes in line with the states efforts to expand the use of electric vehicles given that Egypt is a promising country for manufacturing transport vehicles. Baghdad-INA A member of the Parliamentary Finance Committee for the Saeron Alliance MP Majida Al-Tamimi rejected the tax deduction.

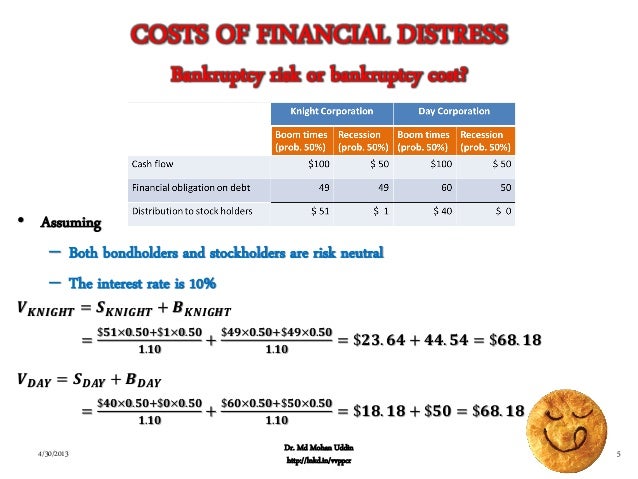

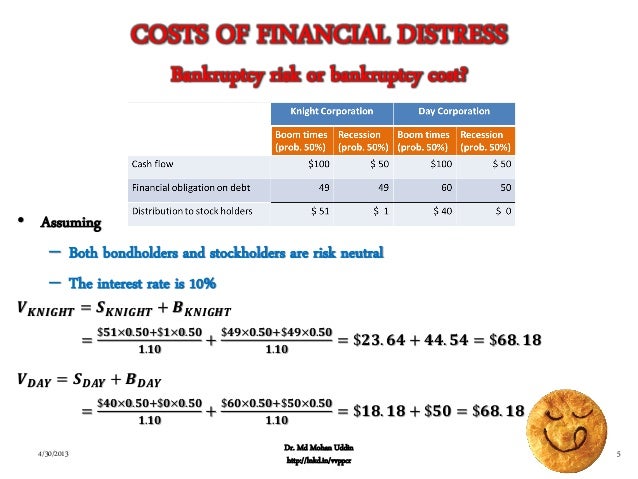

Capital Structure Limits To The Use Of Debt

How To Open A Cbse School School School G Start Up

Usd Vs Inr Rising Astrology Predictions Astrology Predictions Astrology Predictions

What Is Udhyog Aadhaar Registration Certificate Income Tax Enterprise Development Finance

Disability Tax Deductions Disability Help Disability Disability Advocacy

Las Fobias Mas Curiosas Threat Fintech Fear

Pin On Farm Animals Worksheets

Old Vs New Tax Regime Here S All You Need To Know Regime Money Blocks Tax

0 Response to "deduction 50 ministry of finance"

Post a Comment